Oil and Gas Value Chain – by Dev Aravind

This article is written with an objective that readers get a glimpse of the various activities starting from identifying and assessing Oil & Gas reserves to extraction of hydrocarbons, and the eventual selling of refined derivative products to consumers.

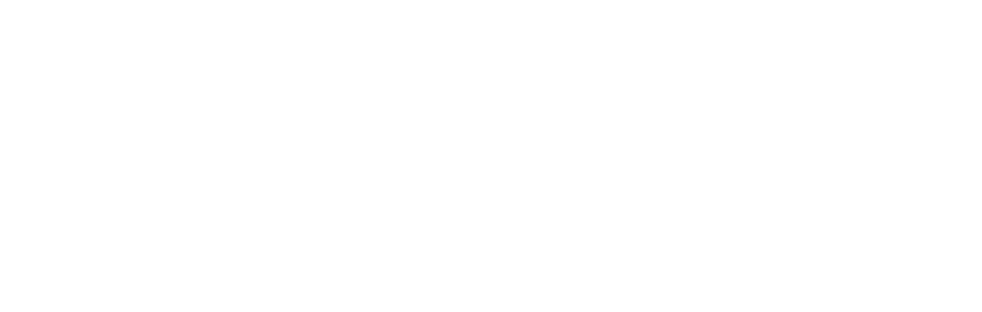

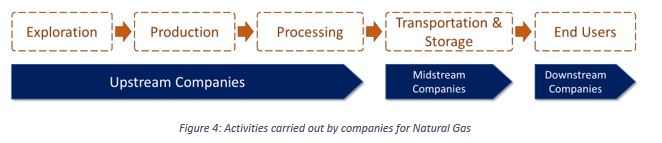

The three facets of the value chain are:

Upstream – Exploration and Production

Midstream – Transportation and Storage

Downstream – Refining and Retail Markets

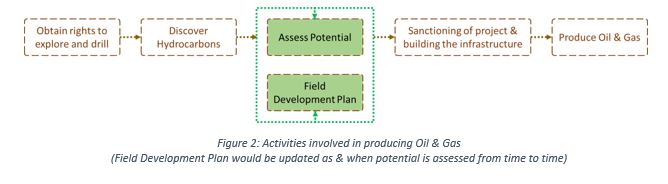

Companies in the upstream sector are also called “Exploration and Production (E&P) companies”. These companies are primarily involved in identifying and assessing potential Oil & Gas producing blocks, drilling exploratory wells, devising Field Development Plans (FDPs) & developing infrastructure in economically viable oil fields to produce commercial quantities of hydrocarbon.

Companies in the midstream sector are typically involved in transportation of hydrocarbon. The various modes of transportation include pipelines, maritime, rail and road transportation, depending on the type of product being transported.

Companies in the downstream sector are involved in the process of refining, marketing & selling. These companies transform & refine crude oil into a variety of derivative products such as liquefied petroleum gas, gasoline, jet fuel, diesel oil, other fuel oils etc., which are in turn, sold to different end-users.

A brief snapshot of the value chain in Oil & Gas is shown in the below figure.

Upstream Sector: Exploration and Production

The upstream sector is a high risk & high reward sector where companies employ a mostly pre-defined framework to identify, assess and progress towards producing hydrocarbons. This is because an upstream company’s success stems from a combination of (i) adherence to the basic principles of petroleum geology, reservoir engineering and physics involved in the drilling process, and (ii) application of the principles mentioned above to suit an onshore or offshore environment.

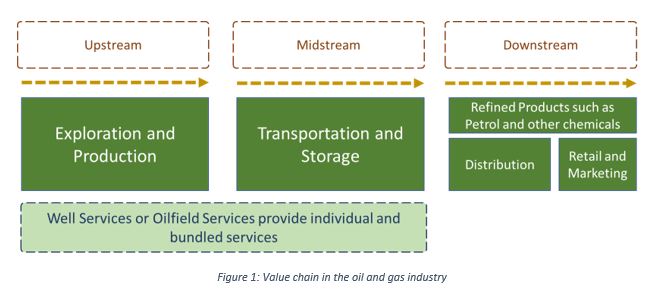

These companies generally conduct seismic surveys to assess fields for the potential presence of hydrocarbon reserves. Soon after they have established the presence of hydrocarbons within a particular block, they devise a suitable FDP. On the basis of the FDP, wells are then drilled to extract Oil & Gas, with the extracted hydrocarbons being sold to downstream companies who refine and sell the derived products to customers.

This production process broadly involves the workflow as shown below.

Further, these upstream companies either themselves or with the help of the oilfield services companies, start campaigns to strike ‘First Oil’ and eventually start producing Oil & Gas.

Few Key Challenges in the Upstream Oil & Gas Sector

* It is highly regulated by governmental agencies

* Getting new exploration fields involves heavy upfront investment

* Even though drilling programs account for estimated subsurface or subsea pressures, possible fluctuations in reservoir pressure, could lead to increased capital expenditure

* The uncertainty of seismic and geological data failing to translate into a commercially viable FDP could lead to a financial loss for an E&P company.The upstream companies may recover partial or no investment

* Maintaining the reservoir pressure to keep a sustained production requires highly accurate analysis and repetitive studies to closely monitor the pressure levels

* Human resource utilization is critical for an E&P company. Involves companies having employees on their payroll and contracting their work to external contractors during peak work periods such as drilling campaigns etc.

Upstream companies carefully plan to utilize their resources to ensure maximum profitability, through various means as listed below:

* Use of advanced technology & concepts

* Adoption of best practices

* Use of talented human resources. The optimum balance between in-house and outsourced work

To catalyze an E&P company’s efforts to implement the above-mentioned, Oilfield services companies enable E&P companies to meet their goals through provision of a variety of integrated services and various software offerings. These companies help in the construction, maintenance and monitoring of infrastructure in proven oilfields.

Well Services Companies

Considering the high risk and investment involved in E&P activities, the need for highly specialized equipment and services is paramount.

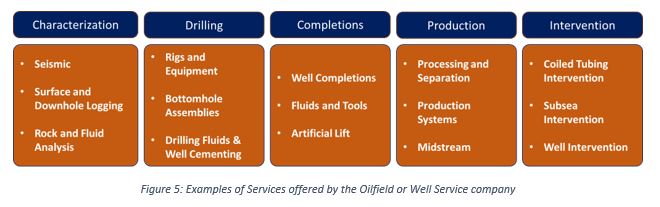

This gave rise to a new set of companies that provide oilfield services. These companies come into the scheme of things once an E&P company has decided on a production strategy and has devised an FDP to develop a particular oilfield. E&P companies then proceed to identify different oilfield services companies that can meet their proposed infrastructural requirements. Oilfield services could include individual services such as well services (well construction and completion equipment), supplying of mud, chemicals etc., or bundled services (a combination of individual services) that the upstream/E&P companies might require.

The oilfield services companies perform many field-level services ranging from characterization, drilling, completions to any interventions that may be required. Each of these broad services are further classified and a brief snapshot is shown below.

Few Key Challenges faced by Oilfield Services Companies

* The adoption of latest technology, equipment & other resources

* The significant capital expenditure required to keep abreast with the latest trends in technology & equipment design

* Usually the equipment & other assets are the onus of service companies until delivered to a designated client

* External factors include: country specific regulations, port/area operations timings, other external dependencies

Midstream Sector: Storage and Transportation

The midstream sector companies transport produced hydrocarbons from upstream companies to downstream companies, who in turn, refine and sell the derived products to the end customers.

The activities of the midstream industry include transportation, processing, and storing of hydrocarbons such as natural gas, oil, and natural gas liquids (NGLs). Each one of these energy commodities has its own linked set of midstream assets designed to maximize the value of every barrel that comes out of the ground.

The midstream sector has the below listed activities:

- Gathering and Processing

- Transportation

- Storage (in some exceptional cases) and Logistics

The midstream companies gather Oil & Gas separately after some field level processing.

Oil Gathering: In the case of offshore production, a network of smaller sized field gathering pipelines accumulate the oil that then moves along the coast or through rivers in smaller barges & is transported internationally in tankers or vessels. In the case of onshore production, land transportation consists of sets of pipelines, trucks and rail.

Natural Gas Gathering: Natural gas generally flows at a much higher pressure than crude oil. Hence, it is transported via large-diameter, high-pressure handling pipelines called transmission lines.

Crude Oil Storage: This happens through bulk terminals, refinery tanks, holding tanks etc. to ensure that the materials are ready to be forwarded to be shipped via a vessel.

These activities done by midstream companies would enable downstream companies to leverage on readily available hydrocarbons to get refined and sold to end customers.

Few Key Challenges in the Midstream Oil & Gas Sector

* The Midstream companies rely heavily on operations of upstream companies

With high external dependencies, it is difficult for midstream companies to scale-up/scale-down the infrastructure (predominantly permanent) that consume large amounts of resources

* Pipeline maintenance & other logistics involved require skilled human resources that strain midstream companies’ finances

Downstream Sector: Refining Hydrocarbons and Retail

The companies in the downstream sector obtain extracted hydrocarbons from the upstream sector via the infrastructure provided by midstream companies, and refine them into derivative products. These companies then further extend their work towards marketing the derivative products.

In a refinery, crude oil is transformed into market fuels and other petroleum products. All the products are then marketed through Business-to-Business (B2B) and Business-to-Consumer (B2C) channels by downstream companies.

Refining refers to those processes that transform crude oil and other raw liquid hydrocarbons, into oil products, such as Petrol, Diesel or Liquefied Petroleum Gases (LPG) that are suitable for final consumption.

Distillation refers to the separation process whereby crude oil components are separated into several oil derivatives using their boiling points. This is usually carried out in distillation towers.

Conversion refers to the cracking processes by which lower-value hydrocarbons are transformed into lighter and higher-value products.

Few Key Challenges in the Downstream Oil & Gas Sector

* Downstream companies being the last in the value chain would have to pay a premium for their raw materials

* Although, crude prices & other external factors determine the prices of various fuels & petroleum products

* End consumers tend to associate price fluctuations in the refined products with downstream companies’ pricing policy. Downstream companies face the supply vs. demand problems firsthand with customers

By Dev Aravind

Author – Dev Aravind is a Business Analyst at Hindustan Oil Exploration Company Limited. Having joined the company not too long ago in August 2019, he has swiftly proven himself to be an adaptable and fast-learning individual. In his current role, he is responsible for the consolidated management of the Daily Production Reports of all of HOEC’s producing blocks, as well as the exploration and evaluation of potential opportunities to enhance the company’s business processes. Outside of work, Dev can be found enjoying a good movie or TV series, or keeping up with the latest in music and disruptive technology.

References:

https://www.api.org/~/media/Files/Policy/Safety/API-Natural-Gas-Supply-Chain.pdf

https://blogs.sap.com/2008/03/31/know-the-value-chain-in-oil-industry/

https://moga.saoga.org.za/resources/oil-gas-value-chains

https://www.total.com/en/media/video/oil-and-gas-value-chain#Read%20the%20transcript

http://siteresources.worldbank.org/INTOGMC/Resources/noc_chapter_1.pdf

https://www.gecf.org/gas-data/gas-value-chain.aspx

https://www.slb.com/business-solutions/asset-consulting-services